Bankly - Transfer, Savings and Bills

from Nigeria

Neobank

Classement de l'App Store : 3.5

Fondée en

Privé

Fondée en

Privé

Note: L'évaluation ci-dessous a été générée à l'aide de l'IA (), sur la base de l'analyse des évaluations de l'App Store au cours des 90 derniers jours. Les informations fournies sont dérivées des commentaires agrégés des utilisateurs et visent à vous donner une vue d'ensemble des performances actuelles de l'application et du sentiment des utilisateurs. Plus d'informations ici

Pas encore de commentaire

Bankly is a lifestyle bank for everyday people.

Unlike other bank apps, the Bankly app has unique features that enable our customers to earn as they spend. Pay all kinds of bills and earn commissions. Save for projects and special events while earning a whopping 12% interest per annum with flexible withdrawals. That’s not all. The Bankly app offers much more!

Bankly App Features

NUBAN Bank Account:

• Every customer gets a NUBAN account created automatically after signing up.

• This account is used to receive money and is powered by Bankly MFB.

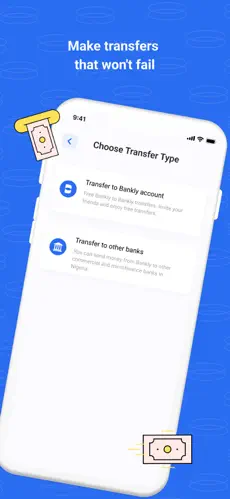

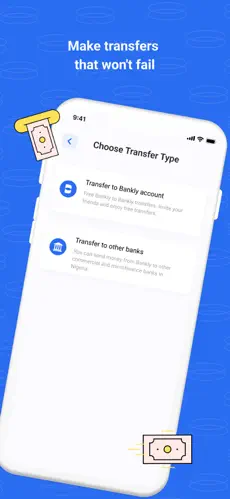

Funds Transfer:

• Customers can send money to any bank account in Nigeria with their account seamlessly, and funds sent are received by recipients in less than 30secs. Our transfers don't fail.

Bill Payments

• Electricity Billers: Ikeja Electric, Eko Electric, Ibadan Electric, Abuja Electric, Jos Electric, Kano Electric, Kaduna Electric, Enugu Electric, Port Harcourt Electric, Benin Electric

• Airtime Billers: MTN Airtime, 9Mobile Airtime, Airtel Airtime, Glo Airtime

• Data Billers: MTN Data, 9Mobile Data, Airtel Data, Glo Data

• Cable TV: DSTV, StarTimes, GOtv

Beta Life Credit:

• With this feature, Bankly users can pay bills and earn simultaneously.

• For every bill payment made on the Bankly app - electricity, airtime, or data – you save up to 2% of the value, which is paid as a commission into your account.

Individual Savings:

• With the savings feature, Bankly customers earn as much as 12% per annum.

• Bankly customers can set targets, and create daily, weekly, and monthly saving plans that accrue daily interest over time.

Save2Win Jackpot Game:

• The Save2Win jackpot game encourages savings by giving users a chance to win as much as N10,000 cash prize daily.

• If a user saves a minimum of N200, they will get a ticket to play in the jackpot game and compete for the daily cash prize.

• In addition, savings are intact even if they don’t win the daily prize, and they still get a 12% interest per annum on savings.

Group Contributions:

• Start a savings plan with family and friends to achieve a common goal

• Savers can leave the savings plan willingly

• To ensure transparency, all members can monitor the progress of their savings, and each member receives notification for every deposit and withdrawal done in the group savings plan.

• Earn up to 15% interest yield on the group savings plan.

Referral Bonus:

• When you refer a friend, you both get a N500 bonus each, when the person registers on the Bankly App and funds their account with at least N500.

• By sharing a unique link, a Bankly customer can cash out N5,000 for every 10 successful referrals.

Account Statement:

• On the first day of every month, users are sent bank statements that can be used to track their financial habits.

• They are also able to request an account statement for specific periods, which can be sent to embassies for immigration purposes, potential employers, or any other purpose unique to the user.

Why choose the Bankly app?

• Bankly makes your overall banking experience simpler and more affordable. Rather than get charged for keeping money with brick-and-mortar banks, here, you earn interest on your savings.

• You also earn commissions on bill payments rather than pay 100 Naira for every bill you pay with other banks.

Contact us

Bankly is a registered trademark of 5554 Technologies Limited Ltd with RC 1509344 as a duly registered legal entity in Nigeria, with the Nigerian Corporate Affairs Commission. Bankly is licensed and regulated by the Central Bank of Nigeria

Address: 11b Oko Awo Street Victoria Island, Lagos

Website: www.bankly.ng

Email: hello@bankly.ng

Whatsapp: 09131038000

Phone number: 07000225522 OR 08039900060

Twitter: @banklyng

Instagram: @banklyng

Facebook: https://www.facebook.com/Banklytech

NG

Voyez ce que disent les autres avant de choisir votre néobanque.

Vous avez des questions ? Nous avons les réponses.

Divulgation des affiliations Au lieu de bannières publicitaires et de murs payants, Neobanque gagne de l'argent grâce à des liens d'affiliation vers les différents fournisseurs de services de paiement présentés sur notre site Web. Bien que nous nous efforcions de rechercher les meilleures offres sur le marché, nous ne sommes pas en mesure de prendre en compte tous les produits disponibles. Notre large éventail de partenaires affiliés de confiance nous permet de formuler des recommandations détaillées, impartiales et axées sur les solutions pour tous les types de questions et de problèmes des consommateurs. Cela nous permet de mettre en relation nos utilisateurs avec les fournisseurs qui répondent à leurs besoins et, ce faisant, de mettre en relation nos fournisseurs avec de nouveaux clients, créant ainsi une situation gagnant-gagnant pour toutes les parties impliquées. Cependant, bien que certains liens sur Neobanque.ch puissent nous rapporter une commission, ce fait n'a jamais d'incidence sur l'indépendance et l'intégrité de nos opinions, recommandations et évaluations.

Le formulaire a été soumis avec succès.

Nous vous contacterons par email

Notre équipe vous contactera bientôt !

Nous examinerons et publierons bientôt votre plateforme !

Merci de nous avoir rejoints. A plus tard !

Votre paiement a été traité avec succès. Nous vous félicitons !

Votre paiement a été traité avec succès. Nous vous félicitons ! Vous avez annulé le processus de paiement.

Vous avez annulé le processus de paiement. Cette fenêtre n'existe pas. Je suis désolée.

Cette fenêtre n'existe pas. Je suis désolée.