If you need cash in a hurry, and you qualify, Dave can spot you up to $500. Buy gas or groceries. Pay bills or rent. No credit check and no interest!

Make money work for you with Dave. We’re leveling the financial playing field with products designed to make finances easier for everyone.

Take control of your cash with a $500 ExtraCashTM advance (1), fee-free Goal tracking, and simple ways to find Side Hustles when you’re behind on your budget.

GET $500 IN 5 MINUTES OR LESS

Remove extra stress with an ExtraCashTM advance. You could get up to $500 after you download Dave, link a bank account, and transfer it to your Dave Spending account. (1) There’s no credit check or interest. There’s also no late fees if you can’t settle on time.

For more information, please visit dave.com/extra-cash-account

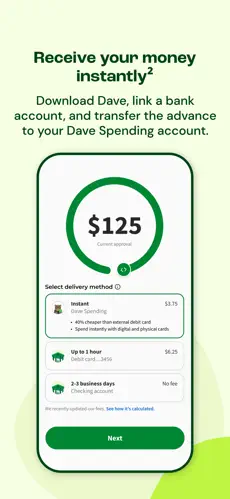

SPEND YOUR ADVANCE INSTANTLY

Transfer your ExtraCashTM advance to a Dave Spending account and spend it instantly with a Dave Debit Mastercard® (2).

GET PAID UP TO 2 DAYS EARLY

With Direct Deposit, you can nab your paycheck up to 2 days early (3). It’s your money, we’re just helping you get it faster.

SAVE EFFORTLESSLY

A vacation, down payment, or brighter future—own your savings journey with a Goals account. You can even set up recurring deposits to build your savings steadily.

FIND YOUR SIDE HUSTLE

Want to make more money? Explore our Side Hustle board and easily apply for part-time roles, gig jobs, remote work, and more.

OUR MEMBERSHIP FEE

There’s a small monthly membership fee that gives you access to our full suite of features, including ExtraCash™, Goals, and Surveys—another way to earn cash instantly.

Disclosures related to the Dave app

1 Evolve Bank and Trust, Member FDIC, provides the ExtraCash account. Advances are subject to eligibility requirements, and are provided as an overdraft, which causes the ExtraCash account to have a negative balance. Express fees apply to instant transfers to a Dave Spending Account. Transfers to other accounts will take longer. The average approved advance is $160 (typically approved in 5 min), updated quarterly based on the prior 6 months. See the Dave ExtraCash™ Deposit Agreement and Disclosures (https://dave.com/extra-cash) for details.

2 Express delivery fees apply to instant transfers.

3 Early access to direct deposit funds depends on timing and availability of the payroll files sent from the payer. These funds can be made available up to 2 business days in advance.

General Terms

See the Dave Spending Deposit Agreement and Disclosures (https://dave.com/deposit-agrement), Dave Goals Deposit Agreement and Disclosures (https://dave.com/account-agreement-goals), and Dave ExtraCash™ Deposit Agreement and Disclosures (https://dave.com/extra-cash) for account terms and fees.

Designed by Dave, not a bank. Evolve Bank & Trust, Member FDIC, provides all banking services and issues the Dave Debit Card, pursuant to a license from Mastercard®.

All trademarks and brand names belong to their respective owners and do not represent endorsements of any kind.

Physical address: 1265 S Cochran Ave, Los Angeles, CA

Votre paiement a été traité avec succès. Nous vous félicitons !

Votre paiement a été traité avec succès. Nous vous félicitons ! Vous avez annulé le processus de paiement.

Vous avez annulé le processus de paiement. Cette fenêtre n'existe pas. Je suis désolée.

Cette fenêtre n'existe pas. Je suis désolée.