Nequi -

from Colombia

Neobank

Classement de l'App Store : 4.8

Fondée en 2016

Privé

Fondée en 2016

Privé

Note: This review below has been generated using AI (16/12/2025 20:00:42), based on the analysis of App Store reviews from the last 90 days. The insights provided are derived from aggregated user feedback and aim to give you an overview of the app's current performance and user sentiment. More info here

The app is currently facing a wave of severe backlash due to critical stability issues, particularly on iOS devices where the app crashes immediately when users attempt to type numbers for transfers. While the platform remains widely accepted and essential for daily transactions in Colombia, trust is eroding rapidly due to frequent downtimes, intrusive full-screen advertisements, and unresolved bugs with new features like "Bre-B."

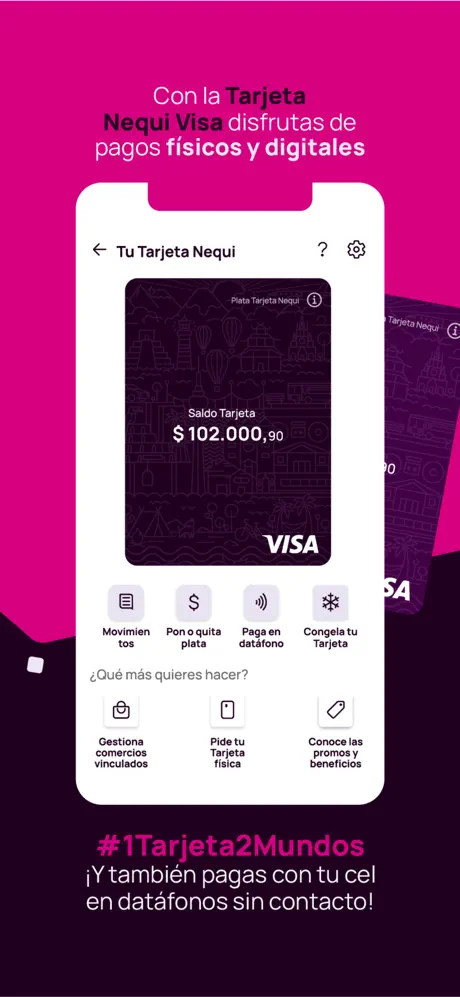

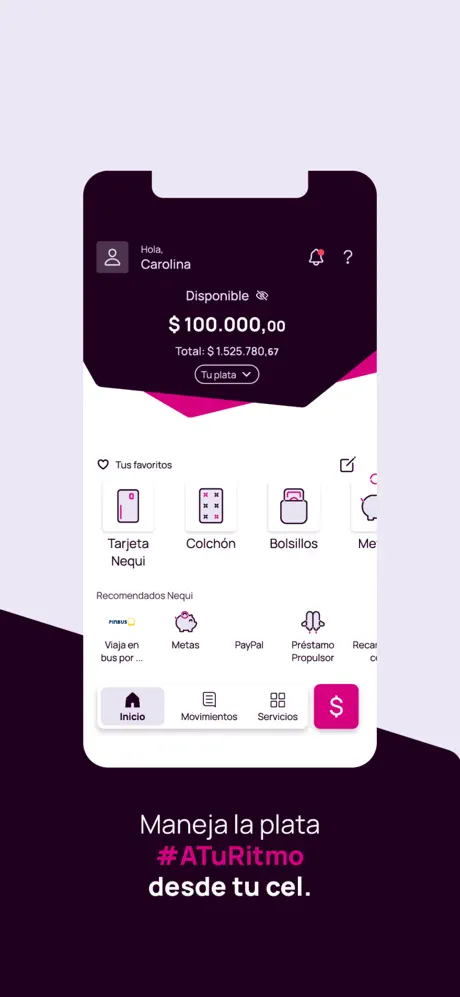

¡Bienvenid@ a Nequi! Somos una plataforma financiera digital de Colombia para que muevas tu plata #ATuRitmo.

¡Te damos la bienvenida a un Nequi renovado, inspirado en personas como tú!

Somos Nequi, la primera plataforma financiera de Colombia que reinventó la forma en la que nos relacionamos con la plata. Todos nuestros productos son 100% digitales y contamos con más de 17 millones de usuarios en todo el país.

Nuestro propósito es mejorar la relación de las personas con la plata empoderándolas para lograr lo que quieren con ella.

Tenemos fuertes protocolos de seguridad y queremos construir desde tu experiencia, para poner la tecnología al servicio de tu vida y bienestar financiero.

Con Nequi manejas la plata #ATuRitmo.

***

Nequi, una marca de Bancolombia S.A.

Vigilado Superintendencia Financiera de Colombia

CO

Voyez ce que disent les autres avant de choisir votre néobanque.

Vous avez des questions ? Nous avons les réponses.

Divulgation des affiliations Au lieu de bannières publicitaires et de murs payants, Neobanque gagne de l'argent grâce à des liens d'affiliation vers les différents fournisseurs de services de paiement présentés sur notre site Web. Bien que nous nous efforcions de rechercher les meilleures offres sur le marché, nous ne sommes pas en mesure de prendre en compte tous les produits disponibles. Notre large éventail de partenaires affiliés de confiance nous permet de formuler des recommandations détaillées, impartiales et axées sur les solutions pour tous les types de questions et de problèmes des consommateurs. Cela nous permet de mettre en relation nos utilisateurs avec les fournisseurs qui répondent à leurs besoins et, ce faisant, de mettre en relation nos fournisseurs avec de nouveaux clients, créant ainsi une situation gagnant-gagnant pour toutes les parties impliquées. Cependant, bien que certains liens sur Neobanque.ch puissent nous rapporter une commission, ce fait n'a jamais d'incidence sur l'indépendance et l'intégrité de nos opinions, recommandations et évaluations.

Le formulaire a été soumis avec succès.

Nous vous contacterons par email

Notre équipe vous contactera bientôt !

Nous examinerons et publierons bientôt votre plateforme !

Merci de nous avoir rejoints. A plus tard !

Votre paiement a été traité avec succès. Nous vous félicitons !

Votre paiement a été traité avec succès. Nous vous félicitons ! Vous avez annulé le processus de paiement.

Vous avez annulé le processus de paiement. Cette fenêtre n'existe pas. Je suis désolée.

Cette fenêtre n'existe pas. Je suis désolée.