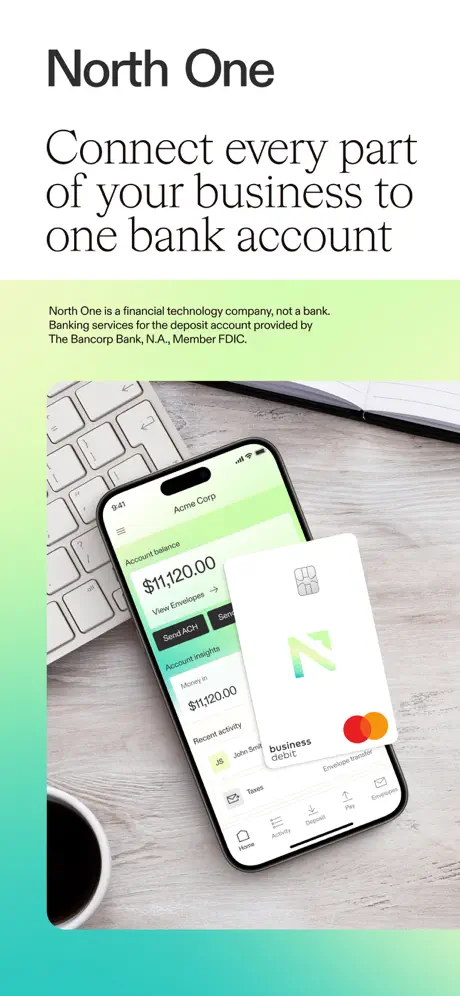

North One business banking makes the hardest parts of running your business easy so you can focus on the road ahead.

Get started for free¹ and:

- Never step foot in a bank branch again

- Buy with physical and virtual Mastercard® Small Business Debit Cards

- Apply for a Business Line of Credit and Business Term Loan⁵

- Send and receive payments from anywhere with Standard ACH, Same-Day ACH, wire transfers⁷, & more

- Deposit⁷ & send Paper Checks⁸

- Receive payments instantly with Real-Time Payments⁶

- Give each of your co-owners their own login and Mastercard® Small Business Debit Card

- Add cash at 90,000+ GreenDot® locations across the country⁷

- Take cash out at any Cirrus® ATM with no North One fees⁴

- Know how much money your business has by connecting to your sales channel(s) like PayPal, Stripe, Square, Shopify, Amazon, and Etsy

Get instant support from real humans

- Talk to a local Customer Care expert who understands your business

- Schedule a call, send us an email, or chat with us live Monday to Friday, 9am to 6pm ET (excluding December 25th and January 1st)

North One is a financial technology company, not a bank.

Banking services for the deposit account provided by The Bancorp Bank, N.A.,

Member FDIC.

The NorthOne Mastercard® Small Business Debit Card is issued by The Bancorp Bank, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Card may be used everywhere Mastercard is accepted.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with this card program.

1. Minimum $50 deposit required. See your Deposit Account Agreement for more details.

2. Based on North One user data. Time saved compared to sending the same type of payment at a traditional bank. Learn how we calculate time saved here: help.northone.com/en/articles/9095567-time-saved-counter

3. Applicable to the North One Standard Plan. Optional North One Plus Plan available for $20/month.

4. ATM Owner-Operators, merchants, and participating banks may impose their own fees and lower limits on cash withdrawals.

5. NorthOne is a financial technology company, not a lender. NorthOne does not issue loans or make credit decisions in connection with loans. NorthOne Lending is powered by Kanmon. All loans are subject to credit approval. Your terms may vary. NorthOne Lending loans are issued by Kanmon, a licensed lender. California Loans are made pursuant to a Department of Financial Protection and Innovation California Lenders Law License. Read more about Kanmon at kanmon.com.

6. Real Time Payments are available through The Clearing House Payments Company, LLC and generally occur within seconds, however certain circumstances could result in a delay or cancellation of a payment. See your Deposit Account Agreement for more details.

7. See Deposit Account Agreement for details on ACH transfers, Same-day ACH transfers, mobile check deposit, physical checks, domestic wire transfers, and third party cash transfers (subject to terms and conditions of GreenDot® Corporation).

8. The North One Account is not a checking account. You can send pre-authorized checks, subject to a fee. See the Deposit Account Agreement for more information.

9. North One Envelopes let you designate a portion of your balance for certain purposes and you can view them on the mobile app or website to help you stay organized. For more information, read the Deposit Account Agreement.

Votre paiement a été traité avec succès. Nous vous félicitons !

Votre paiement a été traité avec succès. Nous vous félicitons ! Vous avez annulé le processus de paiement.

Vous avez annulé le processus de paiement. Cette fenêtre n'existe pas. Je suis désolée.

Cette fenêtre n'existe pas. Je suis désolée.