Discover mobile banking that makes life easy. Spend, save, budget and invest—all while effortlessly offsetting your CO2 footprint. Download and sign up in 5 minutes to start your 30-day free trial today.

Our Plans

EASY CARD - Free

Get an international credit card in just 5 minutes.

• A Free Credit Card you can instantly use with Apple Pay/Google Pay

• AutoAccept payment requests

• Daily chances at great prizes from the Wheel of Fortune

• Access to Finn, your personal assistant

• Parent Access for any account set up for a minor

• Easily set Savings Goals

• Use Places to find recommendations from friends

• Get practical travel tips with Travel Assistant

• Plant a tree for every €1,000 spent with your bunq card

• 24/7 Online Support, Biometrics ID and Deposit Protection

EASY SAVINGS - Free

Earn high interest on your savings and pay zero fees.

Our interest rates per country:

• Germany: 4.01%*

• The Netherlands, Ireland, and Spain: 2.46%

• Rest of Europe: 1.56%

• All the benefits of Easy Card, plus:

• Interest paid weekly

• A Free Credit Card you can instantly use with Apple Pay/Google Pay

• 2 withdrawals per month, included

• No minimum deposit

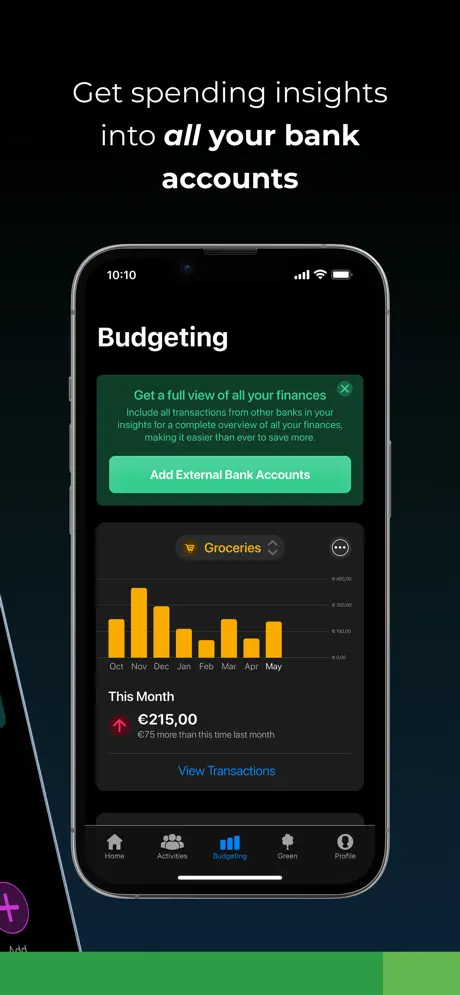

• Add external bank accounts for a full overview of your finances (for NL+DE+FR users)

EASY BANK - €3.99/month

Get a bank account in just 5 minutes.

• All the benefits of Easy Savings, plus:

• Withdraw and Deposit cash at participating stores

• Enjoy instant incoming and outgoing payments

• Schedule Payments for bills and expenses

• List your preferred first name with True Name

• Use Refund Request when you’re not satisfied with a product or service

• Access to a Joint Account and a Joint Savings Account

• Accept and request Shared Access and Dual PIN

• One NL, DE, ES, FR or IE IBAN to match your location

• Added card security against overcharged tips and irregular payments, powered by AI

• Key category insights to help track your CO2 footprint

EASY BANK PRO - €9.99/month

Get a borderless bank account with easy budgeting

• All the benefits of Easy Bank, plus:

• Track expenses with Invoice Scanning

• Automatically pay from the right account or currency with AutoSelect

• 25 Bank Accounts for easy budgeting

• Monthly spending breakdowns and month-on-month comparisons

• Smart Automations automate your saving and spending

• Spend, save, pay and receive in 22 currencies

• Earn interest of 3.71% on USD and GBP

• Get multiple NL, DE, ES, FR & IE IBANs

• Invest automatically with Easy Investments

• No fees when you spend overseas

EASY BANK PRO XL - €18.99/month

Get a borderless bank account with easy budgeting and travel insurance.

• All the benefits of Easy Bank Pro, plus:

• Get Worldwide travel insurance with zero hassle

• Earn 2% Cashback on public transportation, 1% Cashback at restaurants and bars

• Freedom of Choice for where your money’s invested

• Earn more trees and Cashback by inviting up to 2 friends to your Green Team.

• Plant a tree for every €100 spent on card

All our plans are also available for business! bunq Business users benefit from additional features like real-time bookkeeping, Tap To Pay, and other great tools that make managing your company’s finances easy.

Your Security = Our Priority

Boost your bank security with two-factor authentication for online payments, Face & TouchID and 100% control of your cards in the app.

Your Deposits = Fully Protected

Your money is insured up to €100,000 by the Dutch Deposit Guarantee Scheme (DGS), and rest assured that we’re rigorously tested to the same standards as traditional banks.

Investments in the bunq app are powered by Birdee. Investing involves risks, you may gain or lose money.

*Interest rate valid for the first 4 months after opening your account, you’ll earn 1.56% interest thereafter.

bunq is authorized by the Dutch Central Bank (DNB). Our US office resides at 401 Park Ave S. New York, NY 10016, USA.

Your payment was processed successfully. Congratulations!

Your payment was processed successfully. Congratulations! You have cancelled the payment process.

You have cancelled the payment process. This popup does not exist. I'm sorry.

This popup does not exist. I'm sorry.