Invest in the Planet: Earn up to 3.00% APY while fighting climate change! (5)

CHECKING & SAVINGS ACCOUNT

• Sign up to start spending, saving, and investing with a conscience

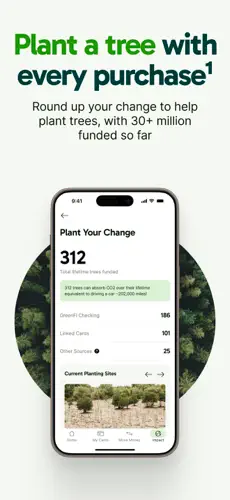

• Fund the planting of a tree with every purchase you make (1)

• Feel good knowing your deposits will not fund fossil fuel exploration or production (6)

• Unlimited withdrawals at over 55,000+ Allpoint ATMs

• Earn up to 3.00% APY. Terms & Conditions apply (5)

• Get paid up to 2 days early (4)

DISCLAIMERS

The GreenFi Checking & Savings accounts are checking and savings accounts offered through Coastal Community Bank, Member FDIC. FDIC insurance only covers the failure of an FDIC-insured bank. FDIC insurance is available through pass-through insurance at Coastal Community Bank, Member FDIC, if certain conditions have been met. Approved deposit accounts are FDIC insured up to $250,000 per depositor. For balances greater than $250,000, Coastal will Sweep the excess funds to one or more FDIC-insured depository institutions in their Sweep network (each a “Bank”) up to $250,000 per Bank. With five Banks available through the Coastal Community Bank Insured Bank Deposit Program (greenfi.com/2024-deposit-account-agreement#page=45), Deposits are FDIC-insured up to $1.25 million per depositor. This amount is subject to change at any time. Visit fdic.gov.

GreenFi Debit Cards are issued by Coastal Community Bank, Member FDIC, pursuant to a license by Mastercard® International Incorporated. GreenFi is under separate ownership from any other named entity. GreenFi is not a bank.

An affiliate, GreenFi Fund Adviser, LLC is an SEC registered investment adviser.

1. When opting into GreenFi’s Plant Your Change Service, we round up GreenFi Debit Card transactions to the next whole dollar amount and transfer the excess to your Plant Your Change Service Account. For details, visit www.greenfi.com/plant-your-change-FAQ

2. Mission Financial Partners, LLC and its affiliates are committed to "All Extra Services Provided at Cost," meaning that we'll only charge you what it costs us to provide the extra service (such as a wire transfer), and not a penny more. Besides these at-cost service charges, customers may make an optional contribution via the Pay What Is Fair (PWIF) program. Proceeds from the PWIF program are recorded monthly in aggregate and donations are made to nonprofit partners selected by GreenFi within 12 months.

3. GreenFi’s Cash Back program is subject to change at any time and without notice, including reversal of rewards for abuse, fraud, and other illicit activity. Cash Back rewards are generally credited on the first day of each calendar month. For details, visit greenfi.com/cash-back-faq

4. GreenFi’s early direct deposit of funds service is not guaranteed, is subject to payor’s support and the timing of payor’s payment instruction, and is based on a comparison of our policy (www.greenfi.com/funds-availability-policy) of making funds available upon our receipt of payment instruction with the typical banking practice of posting funds at settlement.

5. The GreenFi Savings Account’s up to 3.00% Annual Percentage Yield (APY) is variable and accurate as of September 2024. Rates are subject to change. To earn 1.00% APY (3.00% APY if customer is enrolled in GreenFi Plus) on GreenFi Savings Account balances up to and including $10,000.00 in any calendar month, customer must have settled debit card transactions of $500.00 or more, monthly, on their GreenFi debit card. Additional terms apply. Visit our Terms (www.greenfi.com/spendandsavedisclosure) & APY FAQ (www.greenfi.com/APY-FAQ) for details.

6. GreenFi’s Program Banks have formally committed that customer deposits will not be used for lending to oil and gas exploration, production or transportation, or coal mining.

Visit greenfi.com/policies for additional terms and conditions of services.

© Copyright 2025 Mission Financial Partners, LLC

Your payment was processed successfully. Congratulations!

Your payment was processed successfully. Congratulations! You have cancelled the payment process.

You have cancelled the payment process. This popup does not exist. I'm sorry.

This popup does not exist. I'm sorry.