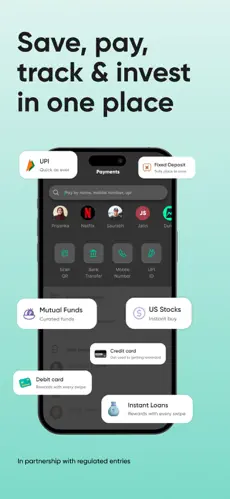

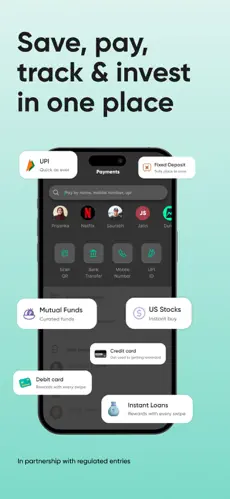

Fi Money - Save & Invest Smart

aus Indien

Neobank

App Store Bewertung : 4.6

Gegründet 2019

Privat |

Fi is an Indian financial app with features that help you get better with your money.

Gegründet 2019

Privat |

Fi is an Indian financial app with features that help you get better with your money.

Note: This review below has been generated using AI (16/12/2025 20:00:42), based on the analysis of App Store reviews from the last 90 days. The insights provided are derived from aggregated user feedback and aim to give you an overview of the app's current performance and user sentiment. More info here

The overall sentiment for the app is overwhelmingly negative, driven by severe technical bugs and a lack of responsive customer support. While a minority of users still find the investment interface user-friendly, the vast majority are frustrated by frozen accounts, login loops, and the inability to contact human staff to resolve critical banking issues.

Open a zero-balance Savings Account online in under 3 mins! As a money management platform, Fi Money is the perfect solution for all your financial needs. The only money management app you need. Via Fi you can open a savings account online, track your expenses, maximise your savings, automate UPI payment online, invest in Mutual Funds & build your wealth! You don’t need to look for other finance apps anymore; Fi Money is all you need.

Get a sleek VISA Debit Card with zero FOREX charges. Powered by cutting-edge tech, connect your other savings accounts to Fi to view a combined balance.

Why Try Fi?

*Money insured up to ₹5 lakh

*No minimum balance

*Zero FOREX markup

*No hidden fees

*Withdraw from any ATM

*24/7 Friendly customer support

FEATURES

Make sense of your personal finance instantly

- Open a new digital zero balance savings account via Fi in minutes

- Use Ask Fi, your intuitive personal finance assistant and get simple answers

- Fi encourages you to build better money habits & manage money online

- Categorise all your expenses automatically

- Fi’s Smart Statements tell you just what you need to know — in plain English.

Get rewarded for saving money

- FIT Rules: Set fun rules that automatically save for you.

- SIP 2.0: Automate investments and transfer money into Mutual Funds on a daily, weekly or monthly basis

- Use Fi regularly to make smart financial decisions, send UPI payments online, grow your wealth & earn curated rewards

- Money doesn’t grow on trees, but on Fi Money, you discover the joy of growing ‘Money-Plants’

You spend smarter, not lesser

- Create AutoSave, AutoPay & AutoInvest rules as you go.

- Smart Deposit: A flexible way to save — designed around you & your goals

- Instant money transfer: Fi Protocol works out the best mode with zero transaction charges

- Fi will auto-create a unique UPI ID for you! Set a secure UPI PIN yourself, then send/receive UPI payment & transfer money with BHIM UPI.

Safe & Secure

• Our licensed partner bank hosts every Digital Savings Account & Visa Debit Card.

• The funds in your zero balance account remain insured up to ₹5 lakh as per the Deposit Insurance and Credit Guarantee Corporation (DICGC)

• Fi Secure also gives you state-of-the-art internet security for your money

You remain in control

- Pay with your VISA Platinum Debit Card, by swiping, tapping and even go contactless!

- Lost/misplaced your card? Tap to order a new one. Or freeze it in-app

And much more!

● No jargon: We will always communicate with you in plain English.

● No paperwork: No branch visits, no queues & no tedious processes⏳

For more: Visit https://fi.money/

IN

Sehen Sie sich an, was andere sagen, bevor Sie Ihre neobank wählen.

Sie haben Fragen? Wir haben die Antworten.

Offenlegung von Partnerschaften Anstelle von Werbebannern und Paywalls verdient Neobanque Geld durch Partnerlinks zu den verschiedenen Zahlungsdienstleistern, die auf unserer Website vorgestellt werden. Obwohl wir hart daran arbeiten, den Markt nach den besten Angeboten zu durchforsten, können wir nicht alle möglichen Produkte berücksichtigen, die Ihnen zur Verfügung stehen. Unser umfangreiches Angebot an vertrauenswürdigen Affiliate-Partnern ermöglicht es uns, detaillierte, unvoreingenommene und lösungsorientierte Empfehlungen für alle Arten von Verbraucherfragen und -problemen zu geben. Auf diese Weise können wir unsere Nutzer mit den richtigen Anbietern zusammenbringen, die ihren Bedürfnissen entsprechen, und auf diese Weise unsere Anbieter mit neuen Kunden zusammenbringen, was für alle Beteiligten ein Gewinn ist. Auch wenn wir für einige Links auf Neobanque.ch eine Provision erhalten, hat diese Tatsache keinen Einfluss auf die Unabhängigkeit und Integrität unserer Meinungen, Empfehlungen und Bewertungen.

Das Formular wurde erfolgreich abgeschickt.

Wir werden Sie per E-Mail kontaktieren

Unser Team wird Sie bald kontaktieren!

Wir werden Ihre Plattform bald überprüfen und veröffentlichen!

Vielen Dank, dass Sie sich uns angeschlossen haben. Wir sehen uns später!

Ihre Zahlung wurde erfolgreich bearbeitet. Herzlichen Glückwunsch!

Ihre Zahlung wurde erfolgreich bearbeitet. Herzlichen Glückwunsch! Sie haben den Zahlungsvorgang abgebrochen.

Sie haben den Zahlungsvorgang abgebrochen. Dieses Popup existiert nicht. Es tut mir leid.

Dieses Popup existiert nicht. Es tut mir leid.