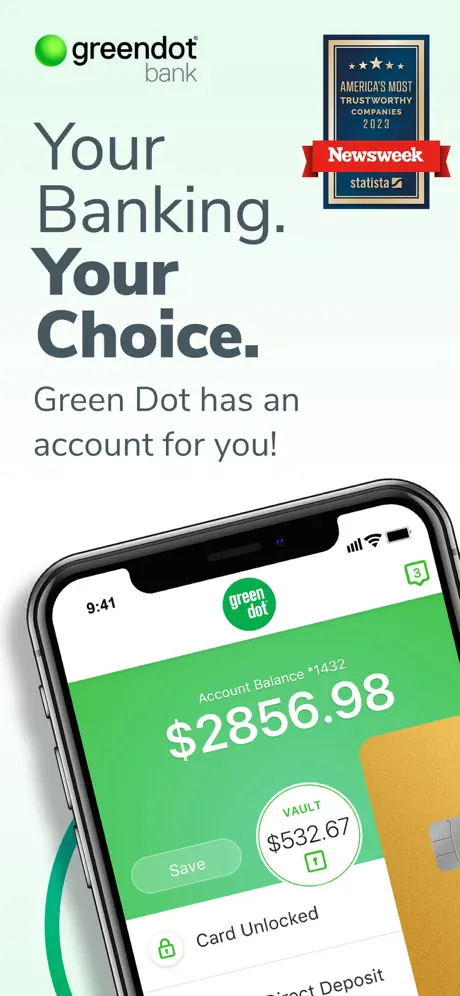

Green Dot has been named one of Newsweek’s Most Trustworthy Companies in America for 2023 and has managed 67 million accounts to date.

Enjoy a range of features across our collection of Green Dot cards including:

Get your pay up to 2 days early and government benefits up to 4 days early with early direct deposit¹

Send money & pay bills3

Deposit cash using the app4

Enjoy no minimum balance requirement

Additional features available across select Green Dot cards:

Access a free ATM network. Limits apply.⁷

Overdraft protection up to $200 with opt-in & eligible direct deposits2

Earn 2% cash back on online and mobile purchases⁵

Save up money in the Green Dot High-Yield Savings Account and earn 2.00% Annual Percentage Yield (APY) on money in savings up to a $10,000 balance!⁶

The Green Dot app is the most convenient way to manage your account.

Register/activate a new card

View balance and transaction history

Lock/Unlock your account

Deposit checks from your mobile phone

Works with mobile payment options including Apple Pay

Set up account alerts

Access chat customer support

Visit GreenDot.com to learn more.

Not a gift card. Must be 18 or older to purchase. Activation requires online access, mobile number and identity verification (including SSN) to open an account and access all features. Activated, personalized card required to access some features.

¹ Early direct deposit availability depends on payor type, timing, payment instructions, and bank fraud prevention measures. As such, early direct deposit availability may vary from pay period to pay period.

² Opt-in required. $15 fee may apply for each purchase transaction not repaid within 24hrs of authorization of first transaction that overdraws account. Overdrafts paid at our discretion. Fees, terms, and conditions apply. Log into your account and refer to your Account Agreement to check feature availability.

³ Active personalized card required. Limits apply.

⁴ Limits and fees apply. See app for participating retailers.

⁵ Available on our Green Dot Cash Back Visa® Debit Card. Cash back is earned on qualifying online and mobile purchases. Cash back cannot be used for purchases or cash withdrawals until redeemed. Claim the cash back every 12 months of use and your account being in good standing.

⁶ Available on our Green Dot Cash Back Visa® Debit Card. Interest is paid annually on the average daily balance savings of the prior 365 days, up to a maximum average daily balance of $10,000 and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 2.00% Annual Percentage Yield (APY) as of July 2023. APY may change before or after you open an account. See Account Agreement at GreenDot.com for terms and conditions.

⁷ See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus whatever the ATM owner may charge. Limits apply.

Green Dot® cards are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. And by Mastercard International Inc. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

©2023 Green Dot Corporation. All rights reserved. Green Dot Corporation NMLS #914924; Green Dot Bank NMLS #908739

Technology Privacy Statement: https://m2.greendot.com/app/help/legal/techprivacy

Terms of Use: https://m2.greendot.com/legal/tos

Ihre Zahlung wurde erfolgreich bearbeitet. Herzlichen Glückwunsch!

Ihre Zahlung wurde erfolgreich bearbeitet. Herzlichen Glückwunsch! Sie haben den Zahlungsvorgang abgebrochen.

Sie haben den Zahlungsvorgang abgebrochen. Dieses Popup existiert nicht. Es tut mir leid.

Dieses Popup existiert nicht. Es tut mir leid.